After three years of turmoil, Canadian Real Estate has finally started balancing. The cooling inflation and two consecutive announcements from the Bank of Canada about steady policy rates are prime factors contributing to an improvement in the market. We are expecting the no. of sales to increase in the coming months. But there are some rising concerns along with the happy news of market recovery.

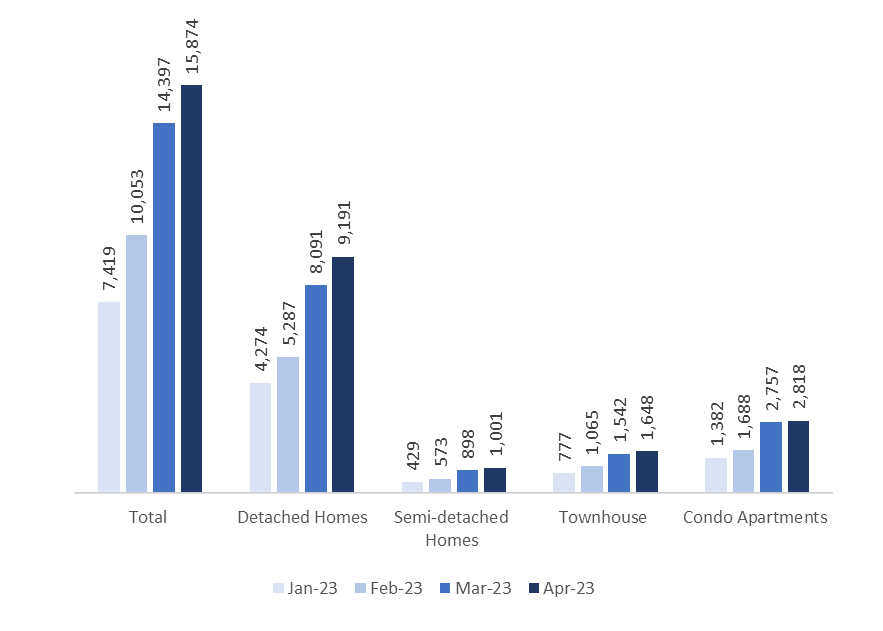

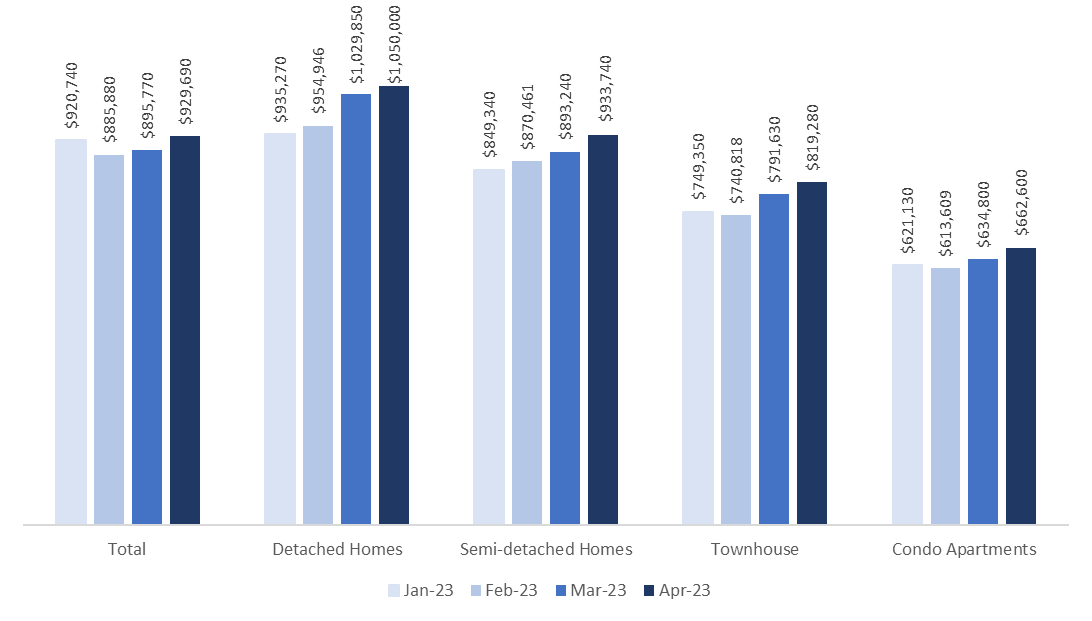

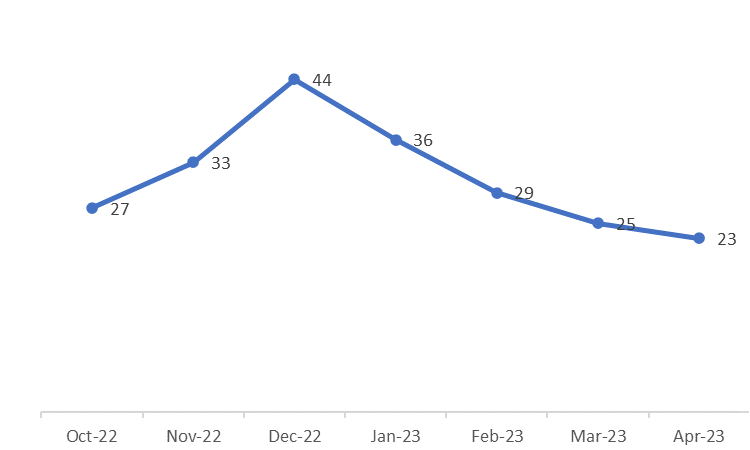

Quick home sales and high-priced homes are clear indicators of an impending shift towards a sellers’ market. In the last few months, the no. of sales has started to gain momentum, and so have the average selling prices, even if it is marginally. In April 2023, there was an increase of 10% in home sales compared to last month. The number of days on the market is reduced to 23 compared to 25 days last month, and the average home price increased by 3.7%. For the last three months, there has been a consistent increase in the number of sales and avg. selling price in Ontario.

With stable interest rates, the prices will likely continue to climb. The sellers will have more room for negotiation, there will be increased competition among buyers, and it can create bidding wars.

NO. OF HOUSES SOLD FOR DIFFERENT PROPERTY TYPES

AVG. SELLING PRICES FOR DIFFERENT PROPERTY TYPES

AVERAGE NO. OF DAYS ON THE MARKET

Mr. Manoj Karatha, Broker of Record of The Canadian Home Realty Inc., adds, “We recommend that buyers make a move now before the prices surge again across Ontario. Over 400K people immigrated to Canada in 2022, contributing to a much higher demand for housing; another 485K are expected in 2024. The increasing population, steady interest rates, and shortage of available housing are bound to drive the demand. As a result, we can expect an increase in property prices.”

TOP 5 CITIES WITH MAXIMUM GROWTH IN SALES

The top cities driving the sales growth in the Ontario region are Ottawa with a 29% increase, Waterloo with a 15% increase, Whitby with a 14% increase and Ancaster with 12%, followed by Cambridge with a 9% growth.

The cities which witnessed the highest price growth include Waterloo, Toronto, Markham, Etobicoke, and Burlington.

| City | Growth in sold units | Change in avg. price |

|---|---|---|

| Ottawa | 29% | 9% |

| Waterloo | 15% | 38% |

| Whitby | 14% | 4% |

| Ancaster | 12% | -10% |

| Cambridge | 9% | 4% |

| North York | 8% | 2% |

| Richmond Hill | 6% | 0% |

| Brantford | 6% | 0% |

| Mississauga | 5% | 5% |

| Burlington | 4% | 9% |

| Vaughan | 2% | 1% |

| Oakville | 1% | 2% |

| Markham | 1% | 11% |

| Kitchener | 1% | -2% |

| Barrie | 0% | 6% |

| Brampton | 0% | 5% |

| Hamilton | -2% | 2% |

| Toronto | -3% | 14% |

| London | -3% | 7% |

| Scarborough | -3% | 5% |

| Oshawa | -5% | -1% |

| Guelph | -7% | 9% |

| Niagara Falls | -8% | -1% |

| Etobicoke | -8% | 10% |

| Pickering | -11% | 4% |

| Milton | -12% | 2% |

| St. Catharines | -14% | 2% |

| Ajax | -22% | 3% |

According to Mr. Robin Cherian, CEO of The Canadian Home Realty Inc., “Given the current trend of selling prices, the number of listings and days on the market, we are expecting a shift towards a sellers’ market. The demand will not match the supply leading to further price hikes. So, if you are a buyer waiting to dip your toes in the real estate market, you should make a move when the houses are still affordable.”

With the Canadian real estate market slowly but steadily recovering from the recent turmoil, it is the perfect time for buyers to make their move. The cooling inflation and stable interest rates have contributed to an improvement in the market, leading to an increase in the number of sales and average selling prices. However, there are rising concerns about the market shifting towards a seller’s market, with quick home sales and high-priced homes being clear indicators. Therefore, it is wise for buyers to act quickly before the prices surge again, as the houses are still affordable. So, take the opportunity now and invest in the Canadian real estate market.

(Source: The Canadian Home App. (Please note that the numbers include data from major realtor boards in Ontario which covers more than 90% of Ontario. The above numbers do not include exclusive listings in CREA and Windsor board data)

Also Read : How to save bank fees in Canada? Let’s start saving.